Commodities - oil - Metals - Gold - Real Estate - money - stocks - the economy - and trade - investment

Monday, August 27, 2012

Should iron ore prices continue to fall, further project cancellations will see higher unemployment.

Based on the number of media reports this week, you'd think that the sky was falling. Although the sky isn't falling, iron ore prices are - and they're triggering a slew of possible events from a fallout in the Aussie dollar to a hole in our terms of trade.

According to a report in the AFR, steel production in China dropped 10% in the opening weeks of August. Product is gathering dust in the face of a weak construction market.

In November last year, US investment bank Goldman Sachs cut its yearly forecast for the price of iron ore by 6%, down to US$167.40 a tonne. They also forecasted an additional 16% drop in 2012, down to US$147.50 a tonne. According to Goldman, by 2012 the price of iron ore would average $US105 a tonne.

In March this year, the Australian Bureau of Resources and Energy Economics (BREE) said iron ore prices would average approximately US$140 a tonne in 2012 and by June had reduced the forecasted price to US$136.

You know where this story is going. None of the above predictions foresaw the price of iron ore dropping below US$100 a tonne, but it did. Just this week, on 23 August 2012, iron ore for immediate delivery fell for the seventh day, dropping 4.9% to US$99.60 a tonne. The chart below tracks the commodities fairly recent slide:

From London, Deutsche Bank analysts are telling speculators to go long iron ore below $US90 a tonne. They foresee panic selling pushing the price to US$90 a tonne - but bottoming soon after. Chinese inventory adjustment could explain the sudden shortfall in demand as the Chinese stockpile inventory - from raw materials to finished goods.

Deutsche Bank argues that the gradual winding down of economic growth in China has made government slow to react with policy measures, unlike the response to the rapid declines in 2008 and the equally rapid stimulus response.

In short, there has been minimal reaction by the Chinese to boost domestic demand - although there has been plenty of talk.

Lower iron ore prices affect our terms or trade - so much so that recent price declines could trigger a $10 million budget shortfall. When the budget was finalised, tax revenue estimates were based on iron ore prices at US$150 a tonne, with the possibility that prices could fall as low as US$120 a tonne. No one foresaw the commodity breaching US$100 a tonne (a level that makes China’s own domestic iron ore industry unprofitable).

Why should we care about our terms of trade? Well, according to Deutsche's economist, Adam Boyton, our terms of trade (or the difference between what the country is paid for exports and what it pays for imports) could decline by 15% through 2012. The warning bells are ringing - if the Government doesn't act fast, Australia could find itself mired in recession. Deutsche believes that the government is overly complacent due to the A$500 billion in resource investment projects already in place.

But resource projects are getting wound back. This week BHP announced that it was scrapping its $A28.73 billion Olympic Dam open pit expansion due to lower commodity prices and higher capital costs. As many as 140 staff will lose their jobs.

Should iron ore prices continue to fall, further project cancellations will see higher unemployment. Early this week the Australian Securities and Investment Commission (ASIC) reported business insolvencies reached record levels through 30 June 2012, with the highest filings in mining states.

In the midst of all this, our third largest iron ore producer Fortescue Metals (FMG) stepped up and delivered a solid earnings report this week, following a tough year for shareholders:

To put their year over year performance in perspective, the average realised price of iron ore over FY 2012 was US$120.2, down 12% from FY 2011’s average realised price of US$136.8.

Yet FMG beat consensus analyst estimates on both revenues and earnings. Here are some highlights from Fortescue’s full year earnings release:

Tonnes shipped (in millions) increased 42% from 39.4 tonnes in FY 2011 to 55.8 tonnes in FY2012.

Revenue was up 23% from US$5.4 billion in 2011 to US$6.7 billion in FY 2012.

Net Profit after Tax (NPAT) increased 53% from US$1.01 billion in FY 2011 to US$1.56 billion in 2012.

Net operating cash flow increased from US$2.77 on 2011 to US$2.80 in 2012.

Earnings per Share (EPS) went up 52% from US$0.329 in FY 2011 to US$0.501 in 2012.

Despite a 25% drop in iron ore prices since the end of Fortescue’s Fiscal Year and sluggish Chinese demand, the company is steaming ahead with plans to invest US$9 billion to triple its production capacity by mid 2013.

Fortescue management foresee iron ore prices rising to US$120 in the “medium term.” If iron ore prices remain stubbornly low, however, the company could be in some trouble. Currently, Fortescue is sitting on US$6 billion in debt and gearing of 226%.

Management hopes to reduce gearing to around 40% by 2014 investors; any additional funding will be accessed by a revolving credit facility.

As a pure iron ore play, Fortescue is vulnerable to further falls in the price of iron ore; interest payments on its massive debt must be met regardless of what happens to China. However, Fortescue steadfastly maintains demand will pick up in China later in the year.

What some investors forget is that China's domestic iron ore industry produces a lower grade of ore which supplies around 30% of the country’s demand. China’s domestic iron ore contains only about 20 percent iron while Australian imported ore contains more than 55% iron.

One argument is that lower iron ore prices can make imported iron ore cheaper than domestic supply. Can China's domestic iron ore industry survive when a superior grade of ore can be imported at a lower cost?

Iron ore production in China is indeed falling and there's already evidence Chinese Steel manufacturers are beginning to look to imported iron ore from Australia and Brazil. If the Chinese replace their own domestic ore with imported ore, prices could bounce.

China’s Premier Wen Jiabao is also spearheading US$23 billion of investment in new steel mills to boost production in auto-making, energy efficient appliances, and housing to jolt China’s slowing economy.

If the price remains below US$100 and declines further, the share prices of our major iron ore miners will take a thrashing; junior miners will fare even worse.

Pure iron ore plays such as Fortescue Metals and Atlas Iron (AGO) are more vulnerable than the diversified giants like Rio Tinto (RIO) and especially BHP Billiton (BHP).

While many Australians think of BHP as just a miner, the company has the most diversified resources asset base in the world. BHP is an oil and gas explorer and producer, and a miner of alumina, coal, copper, diamonds, uranium, gold, and of course iron ore. BHP shares are down almost 15% year over year. Here is a one year price chart for BHP:

Regardless of the benefits of diversification, the prices of copper, coal, and alumina have suffered alongside iron ore - limiting BHP's profits.

In addition, BHP incurred one-off write downs in its US operations. Here are some of the lowlights from the earnings release:

Revenue increased 0.7% to US$72.2 billion.

Operating profit dropped 25.3% to 23.7 billion.

NPAT fell 34% to S15.4 billion, but beat analyst estimates of US$14.6 billion.

Net Operating Cash Flow declined 18.9% to US$24.4 billion.

EPS fell 32.5% to US$0.29.

The health of the mining boom has been under the microscope for over a year and BHP’s ambitious expansion plans were often cited as evidence that all is well.

Just this week, Resources and Energy Minister Martin Ferguson joined the growing chorus declaring the end of the mining boom. His comments came after BHP announced it was stopping the expansion of its US$30 billion dollar copper/uranium/ gold expansion project at Olympic Dam in South Australia.

In all BHP is slashing $US50 billion in expansion projects, including not only Olympic Dam, but also the Port Hedland harbour expansion planned for Western Australia. According to BHP management, the decision was made due to escalating capital expenditures and operating costs, coupled with the fall of commodity prices.

Despite these numbers, not a single analyst downgraded BHP, with only Deutsche Bank, JP Morgan, and RBS Australia scaling back target prices.

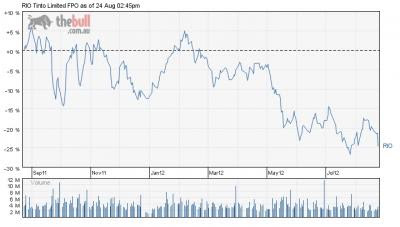

Rio Tinto (RIO) reported half year earnings on 08 August and it is still the analyst favourite. All seven of Australia’s leading analyst firms have RIO as a BUY, OUTPERFORM, or OVERWEIGHT. However, Rio shareholders have not been spared the pain, with the share price dropping almost 25%. Here is a one year price chart:

RIO is well diversified with assets in aluminium, coal, copper, diamonds, gold, iron ore, industrial minerals and uranium. Globally, they rank #3 behind BHP and Brazil’s Vale. Like their Australian rival BHP, Rio’s half year earnings results beat lowered analyst expectations but on a year over year basis were pretty grim. Here are some of the lowlights from Rio’s earnings release:

Underlying Earnings dropped 34%, from US$7.8 billion in FY 2011 to US$5.2 billion in 2012.

NPAT fell 22% from US$7.6 billion in 2011 to US$5.9 billion in 2012.

Net Operating Cash Flow declined 39% from US$12.9 billion in FY 2011 to $US7.8 billion in FY 2012.

Unlike BHP, Rio has no immediate plans to stop work on its $US16 billion planned expenditures on expanding production capability. Company management acknowledges challenging conditions in Europe and a slow recovery in the US, but they maintain their belief economic conditions in China will improve by the end of the year.

At the end of the day, iron ore prices will govern investor sentiment - so keep watch on this space. As the price of iron ore tumbled below US$100 a tonne, BHP’s share price fell 1.14% to $33.04, Rio’s dropped 4.28% to $51.86, and pure iron ore plays suffered even more - Fortescue dropping 5.9% to close at $3.99 and Atlas Iron falling 6.76% to $1.65.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment