Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Fed's move on Thursday to a massive and open ended injection of money into the U.S. economy certainly had an impact in the short term as traders tried to assess the significance of this new QE initiative. It pushed stocks higher and bonds lower in a rather dramatic knee jerk reaction to the announcement on Thursday. How effective the plan will be over time is a matter for careful consideration.

The markets had moved 8% to 12% higher - depending on the stock or the indices one looks at - over the last 6 weeks. Another percent or two was added Thursday after the Fed's new QE - an open ended bond buying program of unprecedented size - was announced. As a trader I admit to a moment of hesitation as I tried to process the impact. I monitored the stock indices but kept glancing over to bond yields, the metals and crude.

What caused me some degree of confusion was the movement in the bond market. The short end of the curve was falling and the long end rising. The Fed's new program wasn't a sterilized purchase like Twist - we were creating new money here - so the short end of the curve falling didn't make sense. Even more confusing was the long end of the curve. Traders were selling bonds and selling them hard. Why? With the Fed committing to buying mortgage backed securities in large quantities the long end of the curve should be stable or falling I reasoned.

I'm not a bond trader and admit that I don't have all the answers but the movement didn't make sense to me. There was something I wasn't processing about all this. I jumped on the Federal Reserve website and read the statement. It seemed a little ambiguous. I wasn't sure if the plan was to buy the bonds on the open market or if the purchases were a normal QE designed to add additional liquidity to the banking system.

It was important to me to know the answers to these questions. I have done a lot of research on QE's impact to the relevant metrics over the last several years and a program designed to add liquidity to the banking system in my opinion was a non-event as we have been stuck in a liquidity trap since the Fed began QE. The proceeds from those purchases would end up being trapped money - setting on the balance sheets of banks and doing nothing.

On the other hand, if the purchases were going to occur outside the banking system then the impact would be more significant. $480 billion a year injected into the economy is huge - almost 3% of GDP. That would be new money and would leave the total money supply flat even after the "fiscal cliff" tax hikes and spending cuts occurred. The Congressional Budget Office has projected the deficit to be reduced by about $500 billion next year and the Fed was effectively making the impact of the tax increases and spending cuts a non-event - at least from a macro point of view.

I admit to still being a bit confused as to how this new money will impact GDP but for the moment at least I have decided that most of the new money would likely flow directly into the stock market. The aggressive selling of bonds along the long end of the curve suggests to me that these bond holders are dumping bonds and planning to move to stocks and metals anticipating ramped up inflation. There is really no other reason that I can come up with to explain why long bond yields would climb when we already know the Fed has every intention of holding yields down on the long end of the curve.

This is significant in that the Fed's money for these purchases will likely go to banks or institutional investors and therefore be reinvested. If my logic is sound the impact will be diminished as the velocity of this new money will be comparatively low. The Fed buys the securities from a seller - the seller takes the money and buys stock or another asset and that is that.

Perhaps I'm missing something but I'm pretty sure what's needed is to break free from the liquidity trap we are stuck in due to fear and uncertainty and driving stocks and metals higher will not achieve that end. As an analyst, this new QE has increased my fear and uncertainty - not reduced it.

If all that's happening here is that the Fed buys agency securities from institutional investors and banks and the institutional investors and banks in turn buy stocks or gold it will add a modest amount of upward pressure to the price of stocks and gold. It certainly won't flow into the broader economy where the velocity of this money could work to spur significant GDP growth.

$40 billion a month is relatively insignificant considering the total capitalization of all publicly traded companies is in excess of $50 trillion. The possibility is real that these funds will work to drive stock prices higher if the trend is higher to begin with but the dollar amount is probably not enough to significantly alter normal market action or direction. High frequency trading algorithms will absorb and overwhelm the volume created by the Fed's action.

In the end I decided we were still dealing with a liquidity trap. For the Fed's plan to work and break us out of the liquidity trap we are going to need more than a stock market rally. If the market response to the Fed action on stocks and bonds translates to a similar reaction on the part of local banks and consumers the plan will work. If consumers react with more disgust and more fear the plan will fail. It is really that simple.

Perception Must Precede Fact For The Plan To Work

The Fed's plan - although they deny it - is to induce an inflationary environment. Perception precedes fact in this instance. If public perception is that we are entering a period of high inflation two things will happen:

Bank lending will increase

Consumer borrowing and spending will increase

As massive as the Fed's move is from a historical perspective - if my analysis is correct - it will have minimal effect on the broad economy as the money won't flow into the broad economy. Additionally the velocity of this money will be nil since it won't flow into the hands of the broad population where it would be used over and over again as people buy and sell with the money driving GDP.

That leaves the Fed action impotent unless it works to change Main Street's perception of what's to come. That seems doubtful. Notwithstanding the fact that this is a move of huge proportions - a "shock and awe" move - it is doubtful the public will recognize this fact or even care. If not, it is a "dead horse" strategy and you can't win the race on a "dead horse".

There is very little empirical evidence to support quantitative easing as a legitimate strategy to affect the desired result. Japan's experiment with quantitative easing is perceived as a failure and critics are quick to point this out. As Bernanke readily admits in speeches and statements the Fed is learning on the fly as evidence of non-traditional policy impact is limited.

Ben Bernanke's legacy is clearly on the line. Prior to the Fed's announcement I speculated on the odds of a new round of QE and discounted the possibility setting the odds of QE3 at zero - a rather bold and ridiculous assessment on my part in retrospect. My logic was that additional QE would not manage to stimulate bank lending or motivate consumers to shift from a cash hoarding mindset to a free spending mindset.

As a part of my analysis that led me to conclude that the Fed would stand pat I did consider the possibility that the Fed had two choices - do nothing at this point or enter into a massive "shock and awe" stimulus plan. The second choice is wrought with risk. My thinking led me to the conclusion that now was not the time to take big risks. It is the Fed's last bullet in their policy gun. If it fails Bernanke's legacy goes down in the history books as an abysmal failure.

We may not know for some time how the Fed's "shock and awe" stimulus will translate in the broad economy but we can at least look at where we are and attempt to speculate on what the Fed's policy move will mean. I don't think it is logical to give Bernanke a passing grade at this point. This unprecedented move is analogous to being down 3 runs in the bottom of the ninth with the bases loaded and the batter down in the count 2 strikes. Anything less than a homerun is meaningless - the game is lost.

Liquidity Trap

Real economic growth must be built on the backs of the consumer. When consumers hoard cash out of fear no economic expansion will occur regardless of monetary policy.

Karen Murdarsi, in her article, "Keynes and the Liquidity Trap", explains in an easy to understand way what Keynes meant by liquidity trap:

Why did Keynes believe that government spending was the way to break the cycle? To answer that we need to look at the other ways of controlling the economy.

1) The government (or the central bank) can try to reduce the 'price' of money by lowering interest rates. The laws of supply and demand say that low demand reduces the price of goods to a level where people want to buy them. In the case of money that would mean reducing the cost of borrowing, i.e. interest rates. The trouble is that in a recession, people may be so unwilling to borrow and invest that it is impossible to reduce the price far enough. Once interest is at zero, there's nowhere else to go.

2) The government (or bank) could increase the money supply - they could literally (or electronically) print more money. The idea is that this money will work its way around the economy, allowing people to spend and invest more, and increasing employment. The trouble is that when times are bad people want to hold on to their money. They don't want to invest it in stocks which might fail, or spend money on goods and services when they fear it will leave them short later. They feel safer holding on to money in 'liquid' form (CASH) which means that all the new money released is hoarded by nervous banks and savers, and does nothing for the wider economy. This is what Keynes identified as "the liquidity trap".

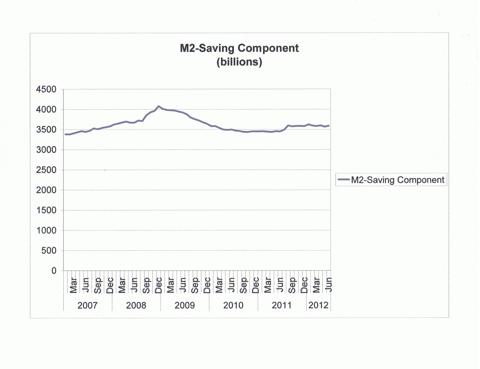

The chart below clearly shows that through QE1, QE2 and Twist America's recovery has been stuck in a liquidity trap. What is particularly interesting about this chart is that M2 and the Saving component of M2 were closely correlated from the beginning of 2007 until the Fed started QE1 in November of 2008. From that point forward the Savings portion of M2 moves higher at a much faster rate

Perhaps we cannot conclude with certainty that the Fed's QE programs were the motivation behind our sudden propensity to save. What we can conclude with absolute certainty is that the Fed's QE programs did nothing to quell our fear since American's started a process of systematic savings that has continued without a slowdown from the time QE began until the present.

The next chart shows the real impact of the liquidity trap. This chart shows the spendable cash in the economy - cash that drives GDP growth. Spendable cash is calculated by subtracting the Savings component from M2. Take note of the fact that real spendable cash actually fell from $3.963 trillion in November, 2008 to $3.589 trillion today.

Looking at just this single metric it is clear that monetary expansion has not achieved its intended result. The Fed's balance sheet has increased by approximately $3 trillion since they started QE. Almost all of that went into savings - not into the general economy where its effects would be multiplied as it moved from one hand to the other. Money velocity has a multiplier effect on GDP growth. As money changes hands it is spent again and again the result being a single dollar might translate to $5 or even $10 in GDP.

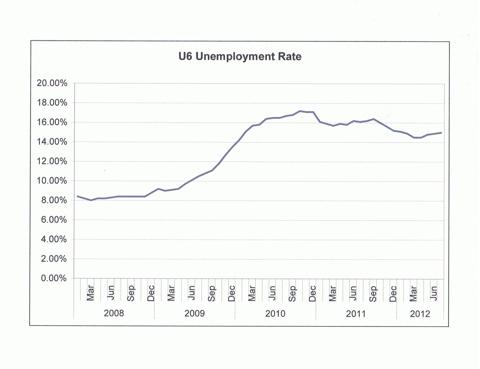

Let's look at another metric - unemployment. There is a very strong correlation between the chart above reflecting the reduction in spendable money supply - resulting from an increase in the rate of saving - and the U6 Unemployment Rate. Spendable income peaked and started its descent in the 1st quarter of 2009 at the same time that U6 unemployment rate started its climb.

Without an increase in spendable money GDP can't grow and without GDP growth unemployment can't fall. Let's look at another metric - GDP growth:

The chart above shows real GDP growth and inflation adjusted GDP growth. After accounting for inflation there has been no growth in the economy at all. This has to be a huge disappointment for Bernanke.

The take away from all this is that for the new "shock and awe" plan to have it's intended effect we have got to break free from the fear and uncertainty that has gripped the nation since the recession. To date we have made no progress at all in any of the major metrics that we look at. As Keynes states:

".. if Investment exceeds Saving, there will be inflation. If Saving exceeds Investment there will be recession. One implication of this is that, in the midst of an economic depression, the correct course of action should be to encourage spending and discourage saving. This runs contrary to the prevailing wisdom, which says that thrift is required in hard times. In Keynes's words, 'For the engine which drives Enterprise is not Thrift, but Profit."

Where's The Market Going From Here?

From a trader or an investor's perspective what we need to figure out is whether or not we should ride the "Bernanke bull" or get off now. It's been a nice ride for the last several weeks but can it continue.

My conclusion is that even under the best scenario - a massive increase in inflation - we have probably priced in the full effect. In other words if the Fed's plan works to raise inflation to maybe 4% - which is in my opinion the outside limit of inflation expectations even if the Fed policy does shift consumer sentiment - that and more is already priced into the market.

We can momentarily get caught up in the euphoria but really how high can we expect the market to go on the backs of even an overwhelmingly successful outcome where the public jumps in with both feet and starts borrowing and buying with frenzy? Consider that the October low on the spot month S&P 500 futures contract was 1068. Friday's close was 1465 - a 37% increase. There is no way inflation can support that kind of move.

You can argue that the October low was not reflective of the real economy if you want and therefore the 37% move in the market is more reflective of reality. I would take the opposite side of that argument and offer up the following facts as support for my argument:

Depression era unemployment numbers.

Flat GDP growth.

Liquidity trap that is locking up all Fed stimulus money.

Pending fiscal cliff issues.

Eurozone recession.

China contraction.

Record debt to GDP ratio.

Failed monetary policy.

That's a short list. If the S&P were at the bottom end of the 12 year trading range I might be a little more positive but we are not. We are at pre-recession highs and a comparison of economic metrics today versus when we were at these price levels pre-recession provides a shocking contrast in economic health.

I have said we are our own worst enemy as it is only through the collective population's increased confidence that we will start to borrow and spend. The Fed hasn't provided that confidence with their policy moves. On the fiscal side it is the same thing. "We the people" just aren't buying and without us no policy move matters. As long as fear and uncertainty permeate the minds of the people they will be prudent and cautious. As long as that continues we will continue to stagnate as an economy.

Monetary and fiscal policy - had it worked - would have made sense. It hasn't worked leaving us in a far worse position than before these massive stimulus initiatives. Now we are dealing with the added problem of credit downgrades. As bond prices begin to reflect in the downgrades and they will, we have the added burden of a dramatic increase in carrying costs on these huge debts.

In conclusion, I think Ben Bernanke goes down in infamy as the one who created the monetary policy stock bubble of 2012. When will the market bubble finally pop? That's anybody's guess. My guess is this coming week. There is no rational justification for stocks adding on to a 37% gain in a year. Even if one sees the Fed policy as positive the market has already discounted the perceived success of the policy.